If you want to invest in the cannabis industry, you’ve come to the right place and you have plenty of good options.

The industry is full of opportunities for first-time investors and seasoned professionals, and you don’t have to build a business from scratch just to get some skin in the game.

As a matter of fact, you can make money in the cannabis industry without ever touching the plant.

This article covers the top five cannabis industry investment opportunities, from starting and scaling your own operation to flipping properties.

But before we dive headfirst into the top cannabis investment opportunities, let’s take a closer look at the different types of cannabis businesses that are out there…

First, Some Cannabis Business 101

Did you know that there are five main types of cannabis businesses, plus several profitable sub-categories?

The five main types of cannabis licenses are:

- Cultivation: growing flower

- Manufacturing: Extraction, infusion & packaging

- Distribution: Supply chain management, brand development, & shelf space acquisition

- Testing: Quality-control services, state mandated purity and potency testing

- Retailer: Retail Dispensaries and delivery service to consumers

Additionally, some states, like California, offer several service-based licenses that are easier and more affordable to obtain, such as:

- Nursery & Processing: part of cultivation process and supply chain

- Packaging & Infusion: internal steps within manufacturing

- Transport: distribution without selling to Retailers, limited compliance steps

TOP 5 CANNABIS INVESTMENT OPPORTUNITIES

For investors who are ready to dive into the cannabis game head first, here’s the top five cannabis industry investment opportunities:

1. FOR TOTAL CONTROL, START A BUSINESS FROM SCRATCH

If you’re up to the challenge, growing a business from the ground up is the most profitable because you’re capturing the ROI of so many different milestones along the way.

The downside is that you have a much higher likelihood of failing, as it takes a long time and there are some unknowns locally and politically, especially when competing for limited permits.

But just how hard is it to start a cannabis business?

The answer…very hard!

Even successful entrepreneurs from other industries find themselves facing the hardest challenge of their life when they start a cannabis business.

It starts with finding the right property for the type of cannabis business you want to create, but this is easier said than done….

Unfortunately, most real estate agents are terrible at curating viable cannabis properties. They simply aren’t aware of the requirements and don’t know how to research them correctly.

Zoning is only the official legal side—another big part of getting the right property is making sure your neighbors don’t hate you and it is well suited for your business with minimal improvement costs. Local residents may not agree with you starting a cannabis business nearby, or you may find issues with the property or facility that make operating more difficult or expensive. From there, things can get even more complicated with obtaining cannabis and building permits, completing buildouts, staffing up, and marketing.

But even with all the challenges, starting a business from scratch is the most common pathway to entering the cannabis industry.

With a company like BeGreenLegal to help guide you, there’s no reason to think that it won’t succeed.

2. FOR FASTER GO-TO-MARKET, BUY AN EXISTING CANNABIS BUSINESS

Does starting a cannabis business from scratch sound like too much of a hassle?

In that case, why not let somebody else take care of the hardest parts for you?

Buying an existing cannabis business is the answer. That way, you can bypass the early headaches altogether.

Not all businesses are at the same level of development, so the price will depend on which stage the business is at in its journey to profitability.

Buying an already profitable business is going to be the most expensive. But there are a number of distressed ones, mostly in non-Retail, entering the market today after funding has dried up that can be acquired for a fraction of the price. The hard part is doing the due diligence to know which one to buy.

The sweet spot is purchasing a property that has a Conditional Use Permit (CUP) or similar land use approval, but no business has yet been approved to operate.

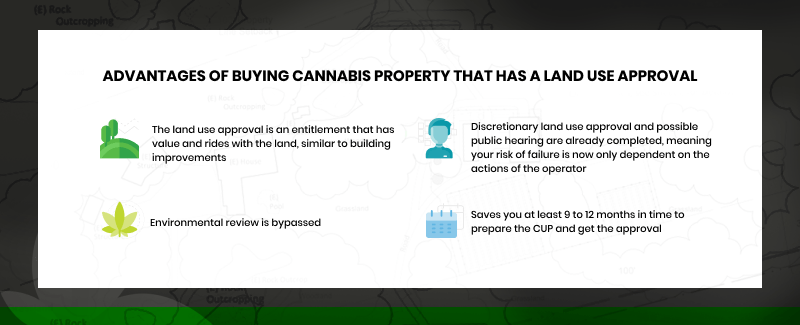

Here’s a few more advantages of buying a property that has a land use approval for cannabis:

- The land use approval is an entitlement that has value and rides with the land, similar to building improvements

- Discretionary land use approval and possible public hearing are already completed, meaning your risk of failure is now only dependent on the actions of the operator

- Environmental review is bypassed

- Saves you at least 9 to 12 months in time to prepare the CUP and get the approval

With that said, a downside is that asking prices can sometimes be unrealistically high and you still have many hurdles, including building/site improvements, setting up a business, getting licensed, and staffing up.

While it is entirely possible to do all of this yourself, hiring a professional will significantly streamline the process and help you avoid mistakes that can get your application rejected and send you back to the starting line, or leave you with a difficult business to run.

3. AQUIRE, FIX AND FLIP A DISTRESSED BUSINESS

For the savvy investor, flipping an existing business, especially a distressed one, can be a profitable cannabis investment opportunity.

Buying a business that already has its CUP and/or state license(s) allows you to save time and side-step a lot of challenges.

Over the course of a few short years, you can build a vertically integrated cannabis business that has incredible resale value and flip it for a generous ROI. One of the biggest challenges for entrepreneurs new to cannabis is that there is a steep learning curve involved with understanding how the industry works and what consumers want.

Buying a single distressed business could be a great starting point to get your feet wet while looking for other vertical or horizontal business opportunities to add to your portfolio that could take advantage of shared costs or cut out a middleman.

Similarly, investors with more experience may find it useful to prioritize certain parts of an overall vertical integration and work around those starting points. For example cultivation may be the most important part of your vertical integration so starting there and working your way down the supply chain may be best. Alternatively, you could select current opportunities as a starting point.

Some of the main benefits of building a vertically integrated business are:

- Lower supply costs

- Higher profits

- Stronger demand

- Greater exit strategy potential

The bottom line is, occupying multiple stages of the supply chain, like cultivation, manufacturing and retail, offers a ton of value to potential buyers.

If you want to learn more about building a flippable, vertically integrated cannabis, you can check out our Vertical Integration eBook here.

4. BECOME A HANDS-OFF INVESTOR IN AN EXISTING OPERATION

This method is for the passive investor who does not want to be an operator at all, but still wants to profit from it.

You inject the cash, kick back, relax, and let the profits roll in.

Fortunately, there are plenty of business owners who are already in the cannabis industry but lack the funding to scale, and that’s where you come in.

As with any business, the equity will depend on how far along the business is towards getting fully licensed and operational.

The main factors for determining value include:

- What the business is making now vs. what the business could be making in the future

- If they’re limited to only a few locations or if they plan to scale indefinitely

- If the business includes the real property, the value of the land that their facilities are located (some locations are better-suited for growth than others)

We recommend doing your due diligence before investing in an existing cannabis business including investigating all legal documents, market potential, the operator’s background including a credit check, company culture, team organization, compliance, and other relevant factors to determine not only whether the business will succeed, but when, how much, and how will great the experience will be.

5. BECOME A CANNABIS REAL ESTATE DEVELOPER

Don’t want to get your hands sticky with growing a cannabis business?

No problem, just stick to flipping properties and leave the dirty work to the other entrepreneurs.

You can still offer a ton of value by buying properly zoned property, entitling it, and landlording or selling to cannabis entrepreneurs who are chomping at the bit to get fully operational.

They get to bypass a lot of the early leg work, and you get to earn a profit in return—it’s a win-win!

YOUR NEXT STEPS

Are you ready to take action with these cannabis industry investment opportunities?

Regardless of whether you want to flip land, flip businesses, or grow them from the ground up, we’ve helped more than a few entrepreneurs break into the lucrative world of cannabis.

As cannabis becomes more mainstream in the U.S., opportunities are rapidly becoming more evolved, more secure, and ripe with opportunities with risks that can be easily mitigated with the right experts by your side.

Through our official discovery process, our experts will help you identify your best fit in the market based on your goals, skillset and location, and you’ll be better prepared to make informed decisions.

We offer…

- Competitive analysis

- Opportunity analysis

- Business strategy session

- Property search and acquisition strategy

- Property suitability assessment fit

BeGreenLegal has helped hundreds of cannabis entrepreneurs build profitable businesses.

Ready to move forward? Let’s get started.