Part 1

Cannabis Industry Overview

The cannabis industry has been experiencing unprecedented growth, even for an emerging market, over the past 25 years. As the legal cannabis market increases year after year due to regulatory changes, many organizations and investors are experiencing how huge the demand is. At the same time, supply often fails to match what the market requires.

With most states now having some version of legalized medical cannabis, and a growing number passing recreational legalization bills, the cannabis industry is a profitable opportunity for potential cannabis investors. Most legal markets are just starting, however, and growth trends that have been seen over the past few years indicate the cannabis industry is still on the ground floor of where it could potentially go in the future.

Massive Growth and Impact on the Country

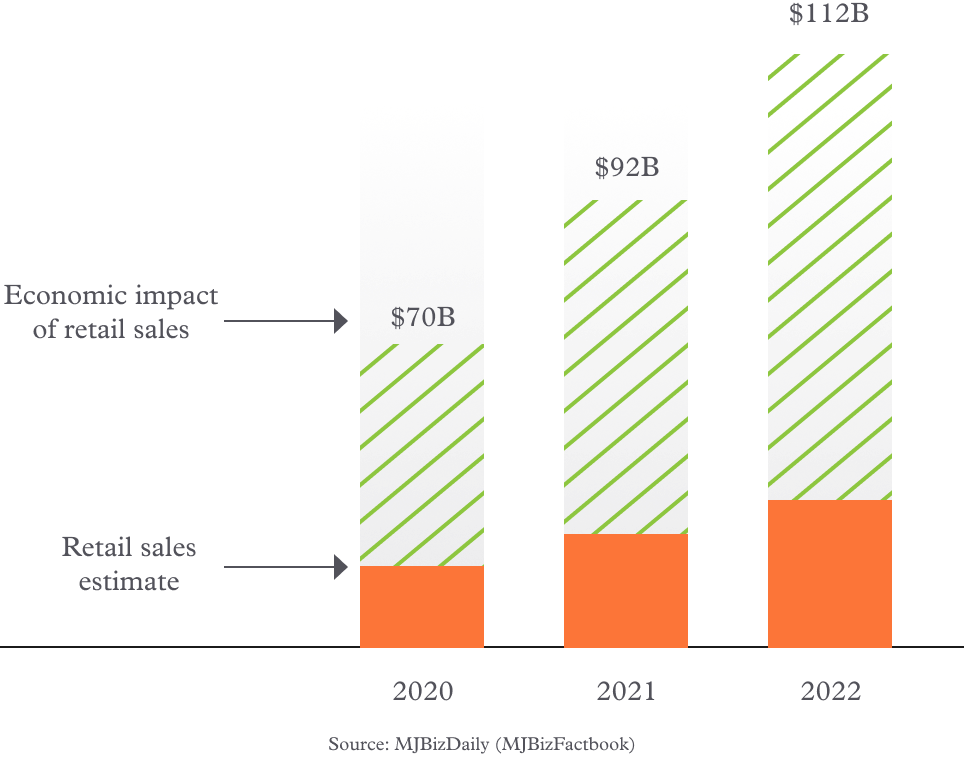

Legal cannabis has snowballed from a few states opening medical coops into a thriving industry that constitutes a significant portion of the economy in some localities. California’s cannabis industry alone will have an estimated $19.9 billion impact on the economy this year. Other states pose similar benefits to surrounding industries over an even shorter period of their specific state’s legalization. In all the states where cannabis businesses operate, the net economic impact nationwide is projected to be $92 billion this year alone.

Economic Impact of Marijuana

in addition to retail sales, the marijuana industry has a significant and continually growing

impact on jobs, real estate, and taxes.

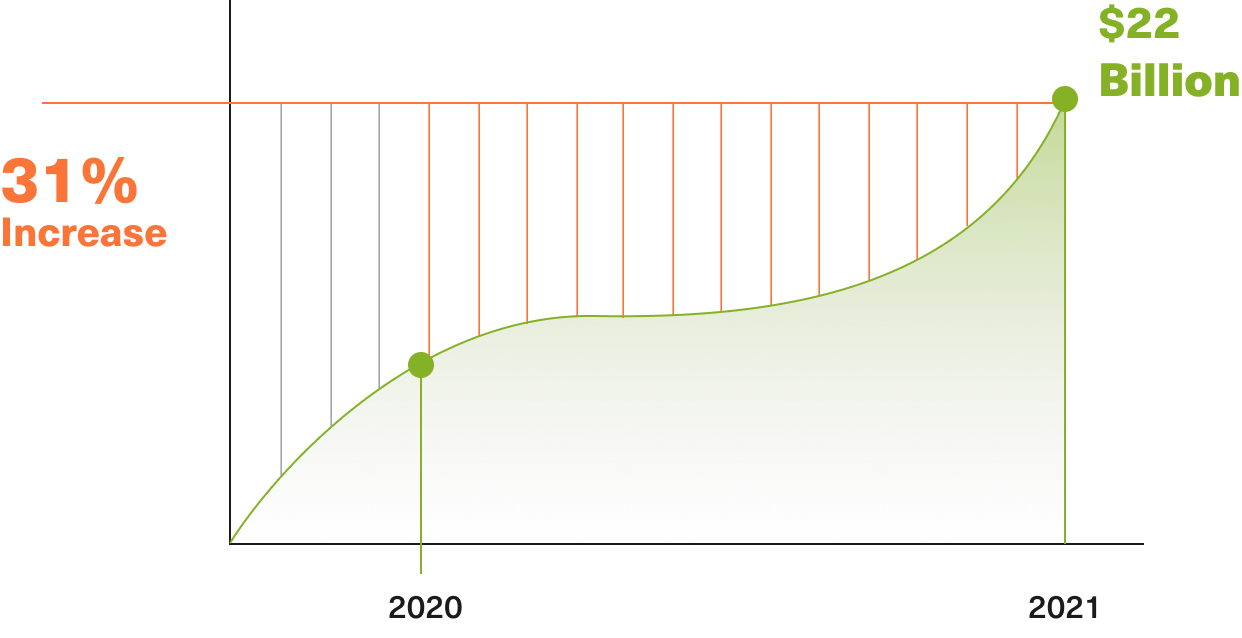

The legal cannabis industry didn’t become a giant overnight—it grew steadily year after year. Total national economic impact increased $22 billion from 2020 to 2021’s current estimate, a growth of almost 31% over just one year.

Year Over Year Impact

The total national economic impact of marijuana increased $22B from 2020 to 2021.

This unprecedented nationwide growth will continue to proceed as more states pass legislation allowing cannabis investments and businesses.

However, growth builds on itself in a compound fashion over time as the market matures. Once a state legalizes cannabis, it can take years for local laws and even other state agencies to catch up. This key factor significantly slows the initial progress of the industry.

In states with the oldest cannabis industries, like Colorado and California, one can see an exponential increase in growth as both local and state governments align to approve projects.

The market is favoring more sophisticated, well-funded organizations

The cannabis market has matured significantly since its initial inception. The landscape of cannabis businesses in early adoption states was at first dominated by local and small businesses, as there was too much risk involved with operating on the shaky legal ground as laws were often vague or disregarded by law enforcement. As more substantial laws have passed that provide stability for operators, the scope of the cannabis industry has expanded exponentially and has become more favorable to higher capital participants with more agility looking for secure cannabis investments.

Private Capital Is A Crucial Asset

For Starting A Cannabis Business

Funding from FDIC insured institutions is not available for cannabis businesses, making private capital

extremely important for getting licensed and operational.

However, because the federal government still considers cannabis a controlled substance and does not allow cannabis to be a part of interstate and international commerce, traditional lenders still prohibit loan approvals for cannabis businesses. And making things more complicated, even landlords and property owners will likely need to find private funding as conventional mortgages are not permitted on cannabis properties. Needless to say, private capital has become extremely important in investing in cannabis businesses, both as debt and equity.

This factor, combined with data showing consistent returns and growth over the industry’s entire history, has made investing in cannabis an incredible potential ROI value, with many of the risks and unknowns of the early market having dissipated over the previous decade.

Part 2

ROI Angles for Cannabis Investors

There are a lot of potential entry points for an investor, depending on your timeline and appetite. A net new business going through the process of being operational will increase in value as essential milestones are met, positioning it for a relatively quick exit and ROI.

The more traditional cannabis investment angle would be to take the business to market and participate in its profits.

Capital is king in the cannabis industry

Operators (individuals or teams building a business to run it themselves) often underestimate the capital requirements of getting to market.

This creates two scenarios. First, many poorly staffed, poorly funded and poorly advised teams compete to get licenses and approvals (required to become operational). And second, operations start to become capital-starved at some point during the process because of setbacks or unexpected expenses. Both scenarios promote an environment where well-funded cannabis investors have clear advantages.

Not only does an investor bring the much-needed capital, but they can also assemble a team of experts in common necessary disciplines, like land development, construction, operations, accounting, legal, human resources, and marketing.

Below, we have broken down a few standard investment angles for the cannabis industry. These aren’t rigid guides, and your ideal strategy will likely combine some aspects of multiple different perspectives. Instead, these individual case studies can help you understand how your investment strategy into the cannabis industry can be customized for your goals and needs.

Our first example is an investor who wishes to utilize their capital to craft a business and hand it over to a buyer. Value is added to the investment by securing the early licensing, approvals, and organization necessary to build a successful cannabis business from scratch.

Investment Angle 1:

Build a business and sell it before operation

This investor will likely be confident in their team’s ability to succeed in a project that calls for the oversight of highly delicate administrative processes. They will have a knack for organizing and crafting successful businesses from nothing.

The win for investors who want to build to sell

To craft a successful and marketable cannabis business and sell it before its operation. This individual’s investment adds value by securing essential licensing, approvals, business structure, and a basic level of facility buildout that allows for immediate operation and maximizes flexibility.

Short Term Investors Value Perception

In a market with a supply limited by access to legal and bureaucratic approval, this investor counts on buyers’ proven willingness to pay a premium for a business that can quickly enter the broader market.

What makes a pre-operational business valuable?

It is common knowledge that cannabis is a valuable product, and there is a significant potential demand across the world. While this potential demand can be readily confirmed with market analysis, cannabis businesses are often viewed as riskier investments because of uncertainties. This is primarily related to whether the approvals needed can be obtained and how much time and money it will take to navigate the process of getting set up legally to a point where one can operate. Consequently, many would-be operators look for ways to circumvent the licensing process and be able to open in only a few months.

It is possible for cannabis investors who are willing to put in the time and money to prepare turnkey businesses. It should include all the proper permits, licenses, and development needed to start operating quickly and reduce the time to market for a potential operator by 18 months up to two (2) years on average.

Your equity is the time the buyer saves

The faster a business can get to market, the better. As an investor looking for near-term ROI, you can capitalize on that. A well-funded buyer that wants to be fast or first to market will purchase your business at a premium if it saves them time.

This value can easily be calculated by reviewing the potential profit from the new business in markets that are currently underserved over the time it would otherwise take to become operational from scratch.

Often, many investors are so averse to these risks on early cannabis businesses that have potentially massive ROI because the process is dense, confusing, and poorly supported at the state and local levels of government. For many states and localities, cannabis laws and licensing are relatively new, the procedures aren’t precisely streamlined, and there are often many people, even officials, who oppose it and will try to hinder your progress. Well-funded cannabis investors who partner with experts who have navigated the process before can often turn this administrative inefficiency into an advantage over the rest of the market.

Who buys a cannabis business that isn’t operational yet?

Our buyers are often happy to reward your cannabis investment in the early process of a business. The entities you will sell these businesses to are usually more interested in the operational aspects of the cannabis business and find the uncertainty of the early gates to accessing the market not fitting with their risk appetite.

You have crossed several important milestones that increase the value of the business and increase the likelihood that it will succeed in the future. Because you’ve done the early parts of establishing a business, the expertise required of your buyers to successfully grow their investment will be much less varied, which further adds to the value of your business to them. You may find buyers specialized in one aspect of the development process, such as real estate developers looking to deliver turn-key businesses to their buyers.

Your buyers will also find the speed at which the business can get to market extremely appealing. The approval and licensing process can be long for the cannabis industry, and that’s in addition to all the everyday work of setting up a business. While this can still translate to a highly healthy ROI on a relatively short-term investment for you, your buyers may be prioritizing speed, and often the licensing and approvals process from states and municipalities cannot be hurried.

This is commonly the situation for cannabis businesses looking to expand, and with this investment angle, they may be your most typical buyer. A locally approved green zoned property will mean that you may be their only option when these businesses want to expand to the area you are building in. These businesses are already experts in the operational side of the industry, and it is worth it for them to pay you a premium for a business ready to take to a retail market.

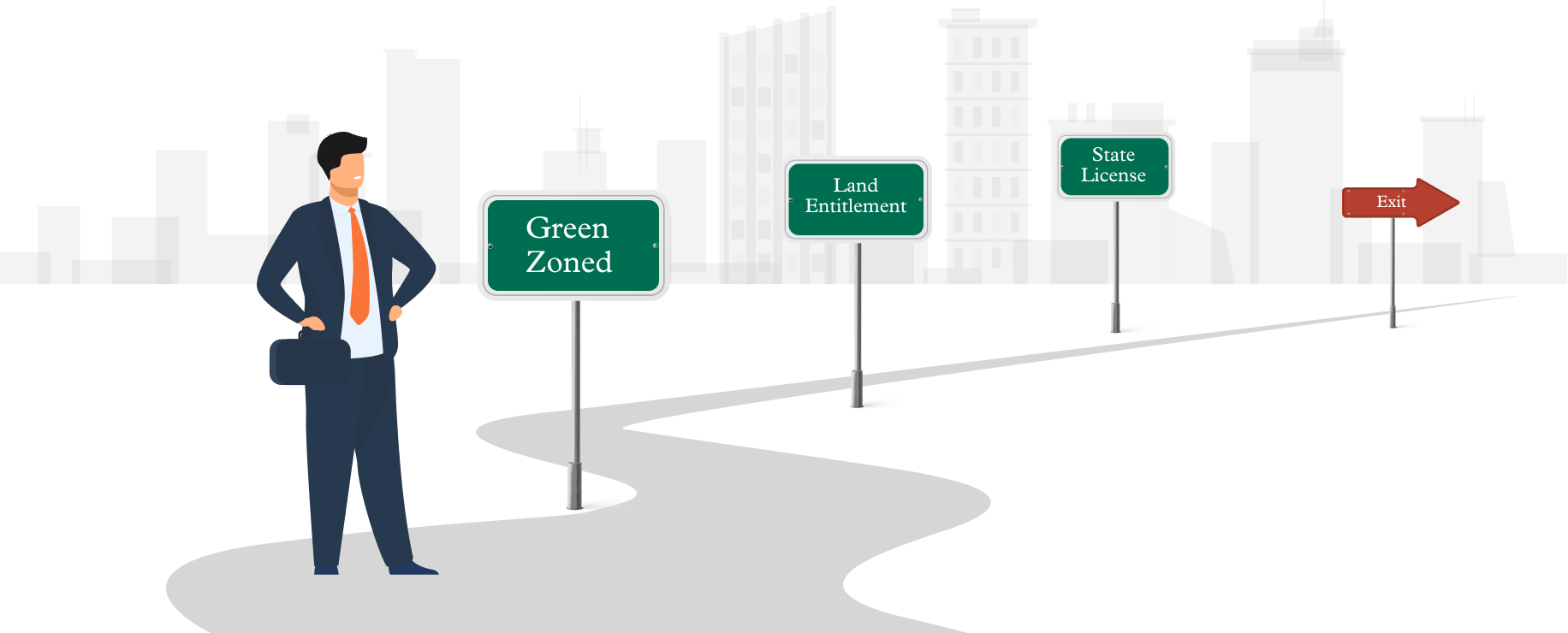

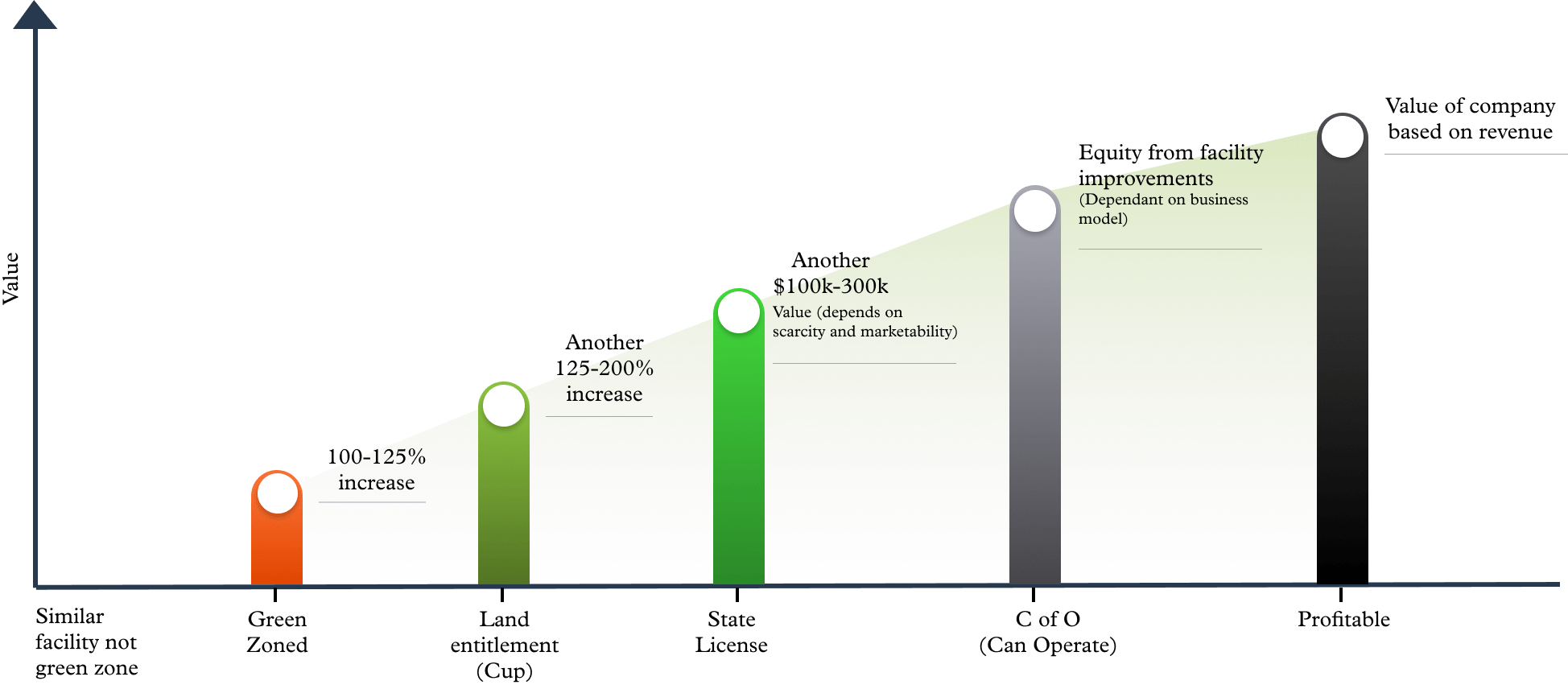

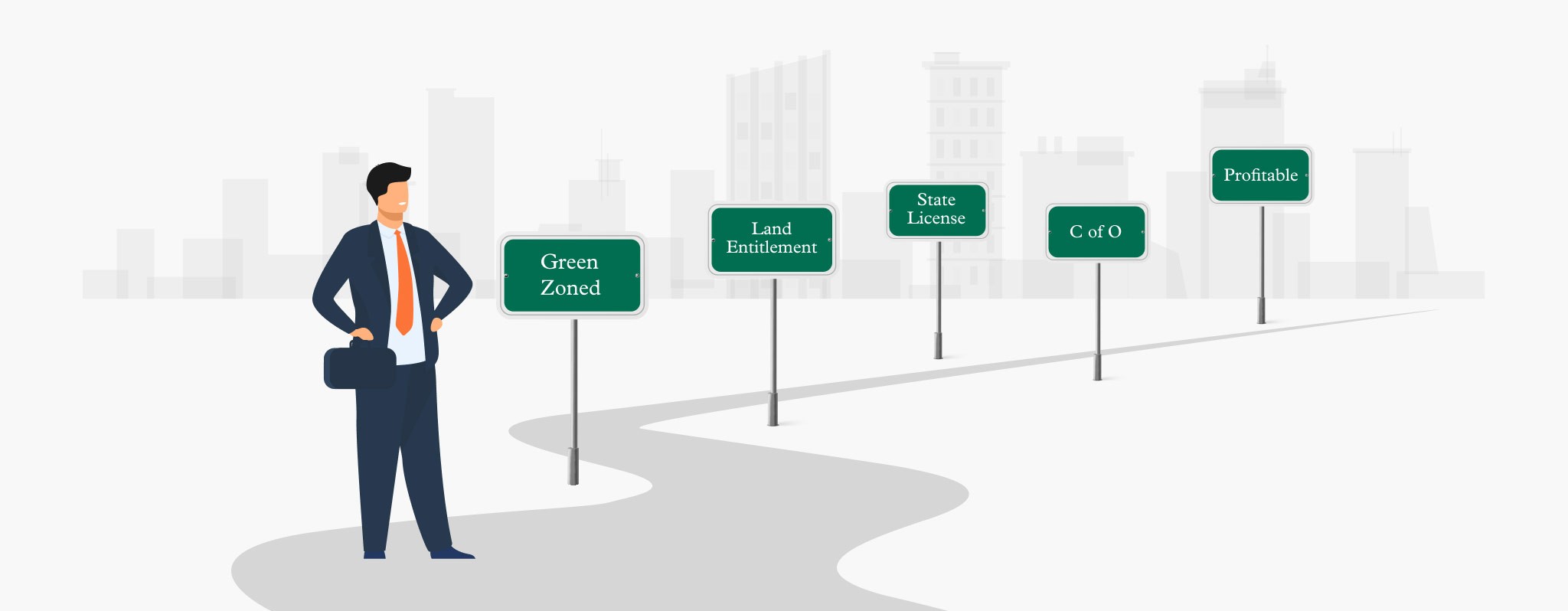

Major Milestones

As with most investments, timing is key. In the early stages of a cannabis business, you’ll see potential returns rise for each significant milestone your operation hits as each step brings you closer to the market. Not all cannabis investors’ goals will be every major milestone, and there could be reasons to determine that you have a different entry or exit point based on your track record of success and expertise. Let’s explore what other types of investors’ strategies may look like further.

While not an exhaustive list, the typical major milestones in the order they usually arise for cannabis business development are:

- Green zone property. Local authorities approve your location as potentially suitable for use in your desired cannabis activity.

- Land entitlement/Conditional use permit (CUP). Local authorities have issued a CUP for the specific usage of the property or facility to be constructed.

- Facilities built. The construction and infrastructure investments necessary to operate the business are completed.

- State licensing. The state has approved your cannabis business for operation.

- Certificate of occupancy. Your final step to operation and entry into the wider market.

Value of a Pre-Operation Cannabis Business

Unlike traditional businesses, cannabis businesses must achieve several state and local government milestones prior to being approved for operation. Those milestones increase the value of the business.

Investment Angle 2:

Build a business to take to market and capitalize on profits

Our second example focuses on an investor who favors long-term profitability and value over short-term returns. In this example, the plan is to take a business through to operation for continued growth over time.

The intention

The intention is to invest in a cannabis business throughout its development and operation for long-term ROI. For this investment angle, you want to provide resources and capital so that an operating partner can have the stability and tools necessary to operate a profitable business that will deliver value over time.

Investment incentives

The ROI that you would have received from the short-term plan detailed above is instead translated into the value of the business if you take it into operation yourself rather than sell before it enters the market. The early work of establishing a cannabis business can create high returns over the short term, but your gains are often still tempered with the uncertainty of an untested venture for your buyers. With the high success rate of cannabis businesses compared to similar organizations, a well-informed and well-funded investor with an efficient operating partner can magnify their profits through a successful operation.

Your Buyers

While you aren’t planning to sell the business before operation in this example, your success relies heavily on finding a qualified and efficient operating partner that you can trust. Even though you are providing the capital for the investment, your operating partner will be investing a lot of time and personal commitment to the business.

The cannabis industry is young and doesn’t have an overflowing market of experts with proven track records. If your chosen operating partner’s expertise and your confidence in them is worth it, you’ll find that selling yourself as a partner to them is just as important as them selling their knowledge to you. You’re not looking for an employee if you want your role to be limited to supplying capital and resources. You’re looking for a partner you can trust and rely on to push your business to success.

Investor Milestones

The timeline outlined in our previous example only takes the business to a ready-to-operate state. Many major milestones beyond being ready to operate will have a magnifying effect on your company’s value. The cannabis industry’s bottlenecks to entry commonly favor established businesses in each area, so each milestone that you achieve will theoretically lower the prospective risk of your venture.

Each step in this phase can potentially be much more specialized to your unique circumstances and business plan than the previous model, though, as the entire focus before becoming operational is on completing tasks that are not related to operating a cannabis business. Instead of meeting several regulatory permits and building a facility, you can now direct your resources to operate in the wider market. Your efforts will need to increase operational efficiency and mitigate competition to increase your ROI from marketing and brand awareness ROI.

Find your operating partner. This is an essential skillset that you will invest in. Your operating partner will share your goals and help you build value over time while you provide resources and capital.

Develop the product. Market research and production capacity will determine the best ways to develop your product for retail or commercial markets. This will depend highly on what type of activity you are engaged in, whether processing, research, cultivation, supply logistics, or retail sales.

Build a brand. With so few widespread names, brand awareness and marketing efforts can hugely impact the cannabis industry. While trust in the overall quality of cannabis products has risen dramatically since the beginning of the market, brand awareness inherently creates confidence in consumers. This can lower barriers to successful conversions for brand recognition and means that brand development efforts potentially provide much larger value than conventional marketing expected ROI.

Define and establish your channel. If you’re operating for long-term gains, you need to set your sights on long-term sustainability. You need to develop a diversified supply and revenue channel to hedge against unexpected setbacks and be agile in case of regulatory alterations. The same fundamentals as any other business operation apply to the cannabis industry. Diversified income and supply streams and healthy investments into overhead and liquid capital over time can establish your business as a sustainable organization that yields healthy ROI and profits well into the future.

Important Investor Milestones

Find Your Operation Partner

Develop the product

Build a brand

Define and Establish your channel

Part 3

ROI Milestones and Timelines

We’ve already discussed some of the major milestones for cannabis investments briefly. Often each of these steps indicates definitive growth of value; it’s worth diving deeper into each of the most significant milestones in the development of businesses and exploring how they can affect the value of your cannabis investment.

Green Zoned Property (100-125% increased value)

Green zoned property has been approved by local authorities for use by the cannabis industry. While localities vary significantly in handling green zoned property, it is typically a boost in real estate value of up to 25%. This percentage also varies greatly between the types of cannabis businesses, with location-dependent industries such as storefront retail commanding large premiums. This makes speculation on possible green zoned land a significant ROI for real estate investors alone, without any further milestones. Further developments on the property will, however, compound on this value.

Land Entitlement/CUP (Another 125-200% increase)

Obtaining a CUP means that not only is your land zoned correctly for a potential cannabis business, but you have been explicitly approved for cannabis use on that land. This is often a significant milestone, as anyone can buy green zoned property, but the permitting process can be complicated in areas with complex issues or political opponents. Consequently, obtaining a land use permit for cannabis clears any political opposition the business may have. This will regularly increase the value of your initial capital by another 125%-200%. This is a difficult milestone for many cannabis investors to obtain if they aren’t adequately prepared, but the potential ROI achieved by this step is massive. Other permits will likely be needed from the local government but are more black and white and do not involve the public.

State Licensing (Another $100-300k increase)

There are fees associated with state licensing, but the financial cost you will invest to obtain the licenses doesn’t even come close to the value of a license once you obtain it. Though regulations differ between states, new license approvals take a lot of time and effort and can be capped, which increases the demand for existing licenses. Many conditions before this step must be satisfied in developing a cannabis business before it will be approved for a permit, so very few cannabis investors are well-poised to get approval at any given time. For all these reasons, once you obtain a license to operate a cannabis business from the state, it could easily add $100,000 to $300,000 to the value of your investment, with additional value-added for higher demand factors such as location and the number of available licenses.

Facility Setup and Improvements (value varies)

Building the facility could have very different effects on the value-added from this milestone, depending on your business model. Improvements in the infrastructure that will allow the business you’ve invested in to operate will always add some degree of value. Still, depending on the type of activity you’re involved in, the returns for adapting land and facilities to your needs could be a significant indicator of potential value in the cannabis industry. For activities like retail sales, improvements to facilities will likely be small increases in value but essential for continued success. For investments in areas like processing facilities, infrastructure development may involve a lot of highly technical and innovative design that may significantly increase the value of your investment once completed.

Certificate of Occupancy (value varies)

Once your business has its Certificate of Occupancy, you’re ready to open the doors and operate a profitable business. This is where all the efforts from the steps that came before will culminate. Suddenly the value of your investment isn’t only the speculative price that a buyer may pay but is the real value of a company, magnified by its revenue should you choose to operate the business yourself.

Part 4

For-Sale Businesses Are in High Demand

The uniquely high ROI potential for each major milestone in the cannabis industry does not deter a great demand from buyers looking to purchase businesses that are already past some of these key-value indicators in their development timeline. There are many reasons why a responsible investor may want to specialize in one aspect of cannabis business development and leave the details of how to get it off the ground to someone else.

Specialization

Just as with those who specialize in getting their ROI from speculating on the green zoned property and those who choose to stick to the building development aspects of the cannabis industry, some are specialized in running a successful cannabis business long-term for appreciating value and profits over time.

These buyers may be operators of an existing cannabis business or have partnered with a successful operations expert. They don’t want to wait through the period of development, planning, and approvals when they could buy a ready-to-go cannabis business and benefit from their expertise right away.

Risk aversion

Despite the growing availability of expertise and resources with proven track records in the cannabis industry, many still view it as a risky investment vehicle. After decades of consistent growth in the industry, though, this is simply not true anymore. Cannabis can present unique risks that other sectors are not subject to. Still, the overall reliability of returns in the cannabis industry is high relative to other investments for well-funded and well-educated investors.

Due to so much hinging on administrative and regulatory approval, the risk for investments does tend to be higher in the earlier stages of a cannabis business. Many simply would like to prevent even the remote possibility of a regulatory change or permit denial throwing hurdles at their investment before it gets off the ground, so they would prefer to pay a premium to those who have already navigated those risks and acquired a business off the ground.

Market limitations

Due to the limitations on state licenses and green zoned property that may vary from place to place but always played a role, demand for businesses that already have met these requirements is always high. As approval for a license can be a major delay, investors with large capital are willing to pay high amounts to purchase ventures that have already achieved regulatory approval.

Part 5

Best Opportunities Per Investor Type

Every investor has a particular skill set that they can leverage for gains on their ventures and has unique investment goals. There is no simple answer for what the best strategy is to invest in the cannabis industry without thinking carefully about what your goals are, what your risk tolerance is, and what your timeframe for expected returns is.

Every person has complex motivations and hopes for the future, and no investor fits into any box. Figuring out the best opportunity for you will reflect your values, wants, and needs. Below we’ll dive into some typical investment profiles as examples to give you an idea of how investors with different types of motivations and goals may craft their strategy to capitalize on opportunities within the cannabis industry in a way that’s best for them.

Real Estate Investor

A specialized real estate investor with experience in identifying and flipping opportunities has a lot of space for quick but healthy ROI. Since there’s a demand for real estate at nearly every step of building a solid cannabis business, real estate investors can commonly find a niche that they are comfortable with.

Profile

These investors are experienced at the property valuation based on market factors and have resources and expertise available to them to help get the most out of identifying opportunities and capitalizing on them for short-term profits. The specialization of these investors is not usually best served by expending capital developing a facility and business model or jumping through bureaucratic hoops for licenses, but rather through capitalizing on opportunities to leverage relatively quick gains for future opportunities.

Intention

The intention of investors that fall into this category is often to invest in property likely to get green zones or already green zoned land that is likely to be in high demand. They aim to capitalize on these opportunities with available capital as green zoned property can quickly appreciate within a given area.

When to sell

Once their goals for market value appreciation on the property are reached, real estate investors often sell the property without ever developing it. Their savvy for identifying real estate that will appreciate means that there are other opportunities that these investors could often move on to with their now increased capital without shouldering the investment risk of developing a costly business.

Land developers

Land developers specialize in adding value through improvement. This can often be one of the areas of cannabis investment with the largest barrier to entry, primarily due to discretionary approvals involving public opinion, such as a CUP, but also because of the costs associated with construction, so experienced land developers will find a unique array of opportunities in the cannabis industry.

Profile

Land developers have experience in taking property with relatively low value and developing it into an in-demand commodity. With the massive ties between value and location in the cannabis industry, land developers’ unique skill set and resources give them an edge in some of the early stages of nurturing an investment through a cannabis business.

Intention

The intention of investors who specialize in land development is often to buy land that is already green zoned but otherwise needs a lot of improvements to be suitable for cannabis. As with other commercial real estate, developers focus on properties with hidden value, such as a green zoned property that could be worth more with a cannabis CUP or utility improvements. While it is crucial to have cannabis expertise on the team, developers of cannabis facilities are more often experienced with land and building improvements.

When to sell

These developers will often look to sell after obtaining land and building approvals or develop the infrastructure and facilities for a business entirely and then sell it as a turnkey operation. They also may wish to lease the business to one or even multiple operators. Land development is always about adding value to the property. The right time to sell may even present itself as a developer obtains approvals and builds infrastructure and facilities needed for the business. It is always helpful to think about exit strategies during development if it becomes more desirable to sell and move on than continue the current path.

Business Investors

For business investors, some of the biggest opportunities out there are happening in the cannabis industry, and the momentum shows no signs of stopping. Successful cannabis businesses can deliver potentially huge ROI over time and can massively increase in value, as we’ve discussed above. Consequently, investors with experience building and running sustainable businesses can find lucrative opportunities investing in cannabis over the long term.

Profile

An investor specializes in business investments with a track record of supporting successful businesses and a strong operational knowledge and resources pool. This type of investor is interested in long-term ROI and is willing to provide the capital necessary for sustainable growth over the years.

Intention

For these investors, obtaining licensing and developing land is the potentially risky part. They, and often their operational partner, have experience growing revenue streams while keeping costs low, building brand awareness, and setting successful operational policies. This type of investor is often more likely to buy a pre-established business or a turnkey operation. Any time and resources spent purchasing or improving a property and obtaining permits and licenses rather than building the business is an opportunity cost.

When to sell

This type of investor often isn’t invested in selling at all. For these investors, capital is typically reinvested heavily into the expansion and growth of the business, which will further compound ROI over the long-term life of the company. As revenue streams increase, so does the company’s value, leading to expanded capital and available credit to take further expansionary steps and future investments.

Part 6

Challenges and Pitfalls

Informed and educated investments involve not only projecting a strategy but also recognizing all the hurdles and challenges that you’ll face on the road to your expected return. The cannabis industry offers pitfalls similar to other industries with government-regulated land use and permitting limits, but with some unique stipulations and conditions.

How these and other challenges manifest themselves in the fledgling cannabis industry is unique and constantly evolving. These challenges are often misunderstood as risk, but just as with any investment, understanding the challenges ahead can help mitigate their potential effects and avoid any unexpected problems.

Licensing and approval process

The licensing and approval process for cannabis varies a lot from state to state. Even within a given state, the regulations and procedures are constantly evolving. No matter what type of investor you are and what kind of strategy you have with your cannabis investments, you need close access to an expert or a resource who intimately understands the regulations and laws within your state and locality.

Local licensing and approval

Local licensing will be your first required approval in states like California and Colorado, while states like Michigan and Florida require state approval first. Regardless, your local approval will likely be the most challenging to obtain unless you compete for limited state licenses. The reason is that your project will be evaluated for how it impacts other businesses and residents in the community and usually requires some form of discretionary approval, meaning your project will be approved based on its merit in view of the public.

Local cannabis approvals start with understanding the restrictions on different types of property based on zoning and land use characteristics. Each city and county have the authority to enact its own rules about how property, including roads, schools, parks, etc., are to be used. Rural areas usually have small local governments that are not used to processing complicated or a lot of applications at once, and it may take months or even years to pass the right policies through the City Council or a Board of Supervisors before cannabis is allowed, even if cannabis is legal in the state. The biggest concerns for rural or undeveloped communities are:

- Environmental impacts resulting from grading, land clearing, and other development activities;

- Community impacts such as increased traffic, security and safety, odor control, and aesthetics; and

- Ensuring facilities are built with the proper building permits is usually the biggest concern.

Concerns For Rural Or Undeveloped Communities

Environmental impacts

Community impacts

Building Permits

Small urban cities that are more developed are not as concerned about grading or building permits if cannabis businesses are located in existing facilities. Still, because these areas are more populated, there is usually more scrutiny based on community issues. Small town and city residents often enjoy quieter lifestyles and are opposed to development in general. They are also more likely to be conservative and skeptical of change as it usually does not happen.

Larger urban centers are more developed and experience change more frequently, so facility, road, and other upgrades are more common. Urban dwellers are typically more tolerant of other people and city life and less likely to oppose cannabis businesses. Obtaining approvals in these areas becomes more about comparing your project to more detailed local regulations that govern suitability, such as whether your business is compatible with health, safety, and even civil rights policies.

Suitable property

Understanding what property is suitable for your intended purpose in the cannabis industry isn’t always straightforward. Most traditional real estate agents don’t know as much as they like to think about finding a property for cannabis use. Green zoned simply means that a particular piece of real estate falls into an area that allows cannabis-related businesses. This doesn’t mean that every property in a green zone will be suitable for your investment, though.

Understanding what property will likely be approved for a Conditional Use Permit for your needs can be nuanced. Still, a green zoned property does no good if you can’t get a CUP to operate a cannabis business. A CUP is an exception to the normal zoning regulations that apply to a specific property for commercial reasons and is arguably your most important milestone to being fully operational.

Once you’ve found a property that can check all these boxes, you’ll have to acquire it. This can sometimes be competitive, especially if other investors have noticed the potential that you have.

State licensing

Depending on your state, state licensing may be the starting point of the approval process for cannabis businesses. These laws are very new, with complicated regulations similar to those in the alcohol or casino industries. It is often challenging to ensure that all of your licenses are processed or submitted correctly without expert oversight. Additionally, state licenses must align with local approvals, meaning good project management and clear strategy and planning for the project are necessary to have a good chance of success. This is where your expertise is essential; if that is not you, a successful cannabis project needs someone who knows the rules and has been down this road before.

If you are applying in a state with a capped number of licenses, it can be difficult to consider approval. The best tool to stand out amongst the crowd is a well-developed business plan that fully demonstrates a firm understanding of all aspects of the operation coupled with a good strategy for winning points in the review process.

Finding industry experts

For many investors, this will be the critical pitfall to healthy ROI in the cannabis industry. The industry has come a long way over the past 25 years, but there are still a few people with long-term track records of success that are not already spoken for by other investors.

This is where capital comes into serious focus, as the best talent can help navigate the ever-changing and often unsure terrain of the cannabis industry, but their scarcity allows them much more freedom to choose the best investors to partner with. In this regard, you’ll often have to sell yourself as an investor to experienced specialists and partners as they are in high demand and are often the key to success in the cannabis industry.

While finding experts in individual aspects of the cannabis industry may prove easier, many facets to investments in this market require diverse expertise. You’ll need to find experts who understand all the nuance involved in:

- Cannabis business strategy

- Cannabis legal regulations and liability protection

- State and local requirements

- Accounting

- Operational requirements

- Land use planning, zoning, and permitting

- Real estate speculation and acquisition

- Market entrance strategies

- Branding and marketing

- Long-term operational policy

Important Considerations When Starting A Cannabis Business

Cannabis business strategy

Cannabis legal regulations and liability protection

State and local requirements

Accounting

Operational requirements

Land use planning, zoning, and permitting

Real estate speculation and acquisition

Market entrance strategies

Branding and marketing

Long-term operational policy

While you’ll probably not find someone who’s an expert in everything, those with prior experience in consulting for and establishing successful cannabis businesses will likely have experience in more than one of these areas. The regulations in the cannabis industry are constantly evolving, so whoever you find for your industry experts will need to be up to date on all the current developments in your state and city.

Entering the market competitively

As with any business, first impressions are essential. While many businesses still see staggering success in the cannabis industry, things have changed dramatically over the past couple of decades. As more capital flows into the industry, things are getting more competitive. Businesses that fail often don’t enter the market correctly and fizzle out before investors see much revenue returns.

Entering the market with momentum is essential for investors who want to maintain control of a cannabis business for long-term ROI. Marketing simply cannot be an afterthought in your business strategy. Brand recognition and awareness are important tools in modern marketing but even more critical in cannabis, with so few universally recognizable trademarks in the industry. With few voices in the crowd, brand recognition becomes much more critical. End consumers rely on brand recognition to make decisions, and you need to establish a strong brand identity before entering the market.

A fully developed marketing strategy grows your brand over multiple platforms. Incentives, social media, promotions, partnerships, and any number of other outlets can be a way to get your name out there and recognized. Developing a brand identity across all these outlets lets you maintain momentum and market to a broad audience.

Part 7

About BeGreenLegal

BeGreenLegal has 11 years of experience helping cannabis businesses launch, grow, and ultimately scale. With outside industry experience in land planning, permitting, and license compliance, we bring a valuable skill set to an industry full of regulations around where and how businesses can operate.

Our team keeps you compliant with the rapidly changing local, state, and federal laws and regulations, providing your business with a significant advantage when acquiring licenses, property, and approvals necessary for launching a new operation. Receive an ROI investment analysis when you schedule an appointment here.

HOW TO MOVE FORWARD

Investment & Profit Analysis

Are you making an investment in building or supporting a cannabis business and want to determine the capital, resources, and timeline requirements for getting operational and profitable? Get an Investment & Profit Analysis today.

Purchase An Existing Business

Want to get to market quicker? See our fully vetted listings of eligible cannabis businesses for sale.

General Inquiries

Please feel free to give us a call at

or fill out our contact form and we’ll get back to you within 24 hours.